SK Hynix posts record high earnings in Q1 on chip price hikes

South Korea’s memory chipmaker SK Hynix Inc. posted all-time high quarterly earnings in the first quarter ended March this year, benefiting from the so-called super cycle in semiconductors when prices jump on both tight supply and strong demand to suggest a lengthy boon.

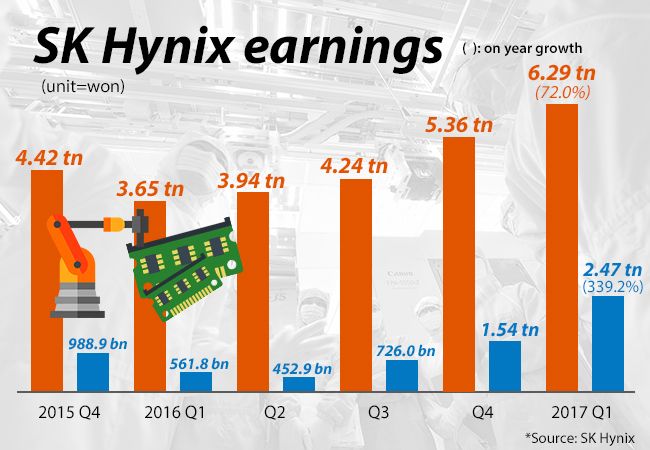

SK Hynix in a regulatory filing on Tuesday reported that its operating profit from January to March expanded by more than four times from the year-ago period and 60.6 percent from the previous quarter to 2.47 trillion won ($2.2 billion). Revenue reached 6.29 trillion won, up 72 percent on year and 17.4 percent on quarter. Its net profit totaled 1.9 trillion won, up 324 percent on year and 17 percent on quarter.

Moreover, its operating margin – the leftover revenue after costs of goods and operating expenses – reached 39.2 percent in the first quarter, the second highest after the 40 percent achieved in the second quarter of 2004 when quarterly income was just 680 billion won against sales of less than 2 trillion won and beating an estimated profitability margin of 19.8 percent of the world’s biggest chipmaker Samsung Electronics in the same period. The stellar performance was in line with expectations.

SK Hynix shares finished Tuesday down 0.38 percent at 52,200 won on bargain-hunting after rallying 5 percent over the previous three sessions ahead of the earnings release.

The company owed the record-high quarterly earnings to “favorable market conditions” that sent product price high during the traditionally slow chip season in the first quarter.

DRAM shipment in the first quarter fell 5 percent from the previous three months, but average selling price (ASP) strengthened 24 percent. NAND flash shipment fell 3 percent, but its ASP gained 15 percent, said Kim Jun-ho, SK Hynix president, in a conference call.

He predicted the price strengthening to continue as demand exceeds supply throughout the year.

According to market researcher DRAMeXchange, the contract prices of PC DRAM DDR4 modules soared to $2.75 as of March 31 from $1.31 in June last year. The price of NAND flash memory also surged by 59 percent to $3.56 from $2.24 over the cited period.

Market experts believe the company would continue to record strong earnings in the second quarter as demands for both PC and mobile memory are robust during the transition towards smart devices and automation in the fourth industrial revolution.

They expect stronger figures in the second quarter, predicting the company could reap as much as 10 trillion won in operating profit for full 2017.

The chipmaker plans to expand production of 20-nanometer (nm) DRAM and begin to mass produce 10-nm DRAM in the second half of this year. It will also supply its 48-layer 3D flash memory chips that have been mass produced since the end of last year, and mass produce 72-layer 3D flash memory chips that the company completed development in the first quarter.

SK Hynix has pledged 7 trillion won in capital investment this year to add a clean room devoted to NAND flash. It will also use the new fads under construction in Cheongju, Korea, and Wuxi, China for 3D NAND and DRAM chips, said SK Hynix chief financial officer Lee Myeong-young.

SK Hynix has the second largest share in the global DRAM market following Samsung Electronics Co., and fifth largest in the flash memory market.

The company is bidding for the world’s second largest flash memory division of Toshiba Corp. to catch up with Samsung Electronics and keep ahead in the flash memory which is in explosive demand to power mobile and smart devices and vehicles and as reliable alternative to computer hard disc drive.