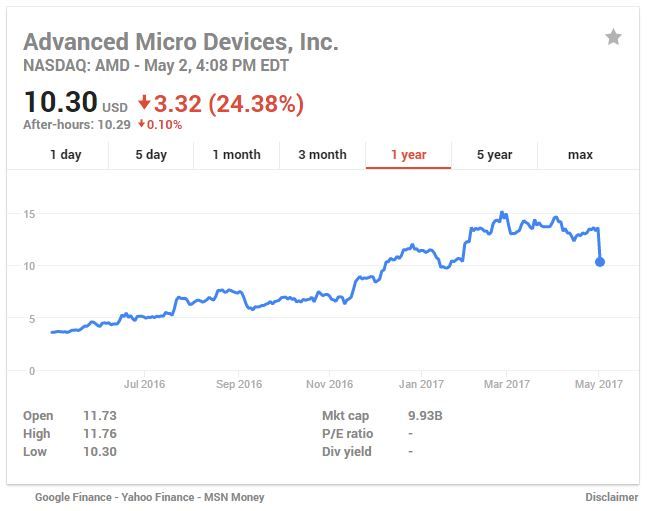

AMD’s Stock Plummets, Worst Single-Day Drop In More Than A Decade

AMD has suffered its biggest single-day stock decline in more 12 years.

AMD reported its quarterly earnings yesterday after the stock market closed, but the company’s stock began plunging almost immediately in after hours trading. Now, twelve hours later, AMD has suffered its biggest single-day decline in more 12 years. At the time of publication, AMD’s stock has fallen 24.38% to $10.35 per share, which is close to the 26.2% loss it experienced on January 11, 2005.

AMD has had a banner year to this point (it wasn’t long ago that we covered its 330% gain), and overall the company quadrupled its share price last year. AMD reported strong results that were in line with expectations, but the fickle stock market punished the company after it revealed lower-than-expected margins and relatively low Q2 margin guidance. AMD reported a 33% margin for Q2, which is only slightly lower than the 34% it posted in Q1.

AMD reported $984 million in revenue (up 18% year over year) and a $29 million net operating loss (down from $73 million year over year) as it claws its way back to profitability. The company also reported an 18% revenue increase due to Ryzen and GPU sales.

Notably, AMD has shipped Ryzen processors for only one month of the quarter, and it also has Vega slated for release in Q2. AMD’s Naples platform will also help contribute moving forward, and market share gains in the lucrative data center segment will be a key growth driver in the future. AMD’s Ryzen 3 processors are also slated for the second half of the year, which could help boost sales volume.