AMD Scores Its Highest Server CPU Market Share in Years: Report

Every 6th server uses an AMD EPYC processor.

AMD’s recent server efforts have been tremendous. The company not only released CPUs with 64 cores and worked hard to win designs with server makers and cloud giants like Google, but it also prioritized producing EPYC processors over client CPUs and GPUs. These efforts paid off in the second quarter as, according to a report from analyst firm Omdia, AMD has reached its highest server CPU market share in years.

AMD Is Gaining Share

According to the report, around 3.4 million data center servers were sold in the second quarter of 2021 (flat year over year). Additionally, server makers earned $21.5 billion due to growing demand from hyperscale cloud service providers.

AMD controlled 16% of data center servers, Intel lost some revenue share to AMD, and Arm-based servers continued to progress, albeit in a limited number of cases. Omdia says that Ampere’s Altra (deployed by Oracle) and chips from Fujitsu and Huawei are the most successful server-grade Arm SoCs.

An avid reader will certainly notice that data from Omdia appears to differ from data shared by Mercury Research last month, which shows that AMD commanded around 11.6% of server unit share in Q2 2021. This happens because Omdia includes all types of general-purpose servers in the report, like mainstream/datacenter machines (blades, rack servers, whitebox servers used by hyperscalers, tower servers, hyperconverged infrastructure servers), edge servers (a small emerging category), and four-socket and beyond servers.

Other firms do not include certain niche types of servers (e.g., machines with four or more CPUs) that sometimes happen to be categories in which AMD does not participate, which is why server-related reports from IDC, Mercury Research, and Omdia can have different perspectives. In the case of Omdia, it only covers data center machines.

Omdia says that AMD’s 16% share in data center servers is the highest share that the company has ever reached in this market segment, but it didn’t elaborate. AMD controlled over 25% of the server market in Q3 2006, based on data from Mercury Research. It’s important to remember that the server market is not only larger than it was in 2006 in terms of units, but the machines themselves are becoming more expensive, so there’s more revenue to be gained.

Hyperscalers Accelerating Purchases

Omdia says accelerated adoption of AMD’s EPYC processors by hyperscalers in general, and Google in particular, helped AMD increase its share in Q2 2021. Cloud providers were Intel’s stronghold for years, but it appears AMD is beginning to gain traction here, just like it gained traction with enterprises.

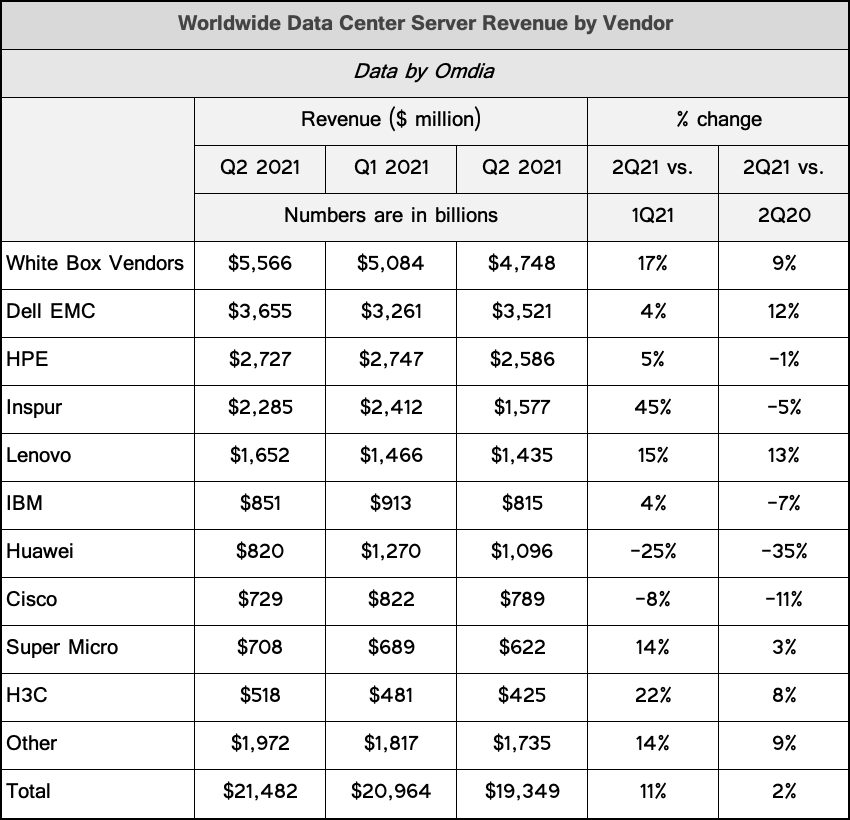

Speaking of hyperscalers, it is necessary to note that they use whitebox servers produced by companies like Wiwynn, QCT (Quanta), Tyan (MiTAC), and Ingrasys (Foxconn). These companies controlled 26% of the market and produced $5.566 billion worth of servers in Q2 2021, up 17% quarter-over-quarter and 9% year-over-year. In fact, hyperscale cloud service providers like AWS, Azure, Facebook, and Google consumed more servers in the second quarter than any server vendor shipped during this timeframe.

Speaking of big server vendors. Dell EMC maintained its lead and sold $3.655 billion worth of servers in Q2 2021. The company was followed by HPE with $2.727 billion (nearly a billion of USDs behind), whereas Inspur was No. 3 with $2.285 billion. Inspur’s sales grew 45% quarter-over-quarter, so the company probably delivered several large orders to its clients in China. Meanwhile, the company’s server sales dropped by 5% year-over-year. By contrast, Lenovo increased its server revenue to $1.652 billion, up 15% QoQ and 13% YoY.

Shipments of Servers at Risk

Since demand for servers is growing, everyone in the supply chain benefits. Omdia expects server revenue to hit $92 million for 2021 and increase by 11% compared to 2020. For obvious reasons, companies like AMD benefit more than makers of smaller components like power management ICs (PMICs) or network controllers. But as ironic as it is, makers of small components may put further growth of the server market in the second half of the year (and therefore server revenue) at risk.

Lead times for some server components extended to 52 – 70 weeks by early July, forcing some manufacturers to procure loads of cheap but critical components, putting additional pressure on the supply chain. PMICs are made on 200-mm fabs that are relatively cheap, but building additional capacity takes a long time, so shortages will persist for quite a while.

Summary

According to multiple researchers, AMD is gaining server market share as the server market grows due to demand from hyperscale cloud service providers. AMD has successfully won designs with enterprise server makers and is now gaining traction with hyperscalers, which almost guarantees steady shipment growth.Advertisement

For now, AMD’s EPYC CPUs have an indisputable trump over Intel’s Xeon processors: their core count. However, component shortages could slow down server shipments and thus AMD’s expansion.